DeFi vs. Web3: Key Differences

Hey there! Ever heard people talking about DeFi or Web3 and wondered what all the hype is about? No worries – we’ve got you covered. These two are shaking up the internet and finance worlds, but what do they really mean, and why should you care? Let’s jump in and explain it in a way that’s easy, enjoyable, and packed with helpful information.

What is Web3?

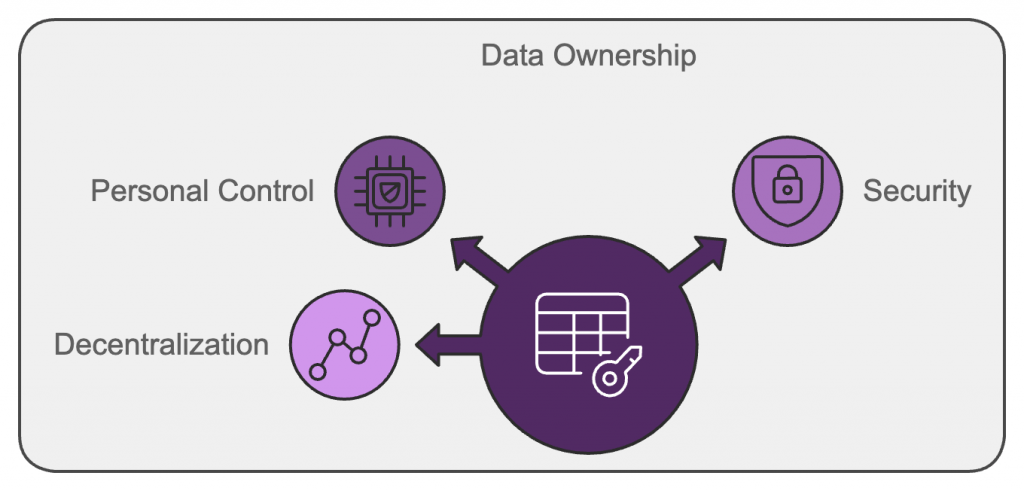

Web3 is the cooler, upgraded version of the internet we use today. Imagine if you owned all the data you share online, removing reliance on big companies like Facebook or Google. That’s Web3! It’s all about putting control back in your hands through blockchain technology, which makes things more secure and decentralized.

Think of it like this: instead of trusting a few giant companies with your personal info, Web3 gives you the keys to your own online world. You get to decide what you share, who sees it, and how it’s used. It is wonderful, isn’t it?

What is DeFi?

Now, let’s talk about DeFi, short for Decentralized Finance. It’s like regular finance but without the banks, paperwork, or all that waiting. DeFi runs on blockchain, too, and it’s all about cutting out the middleman.

Want to lend or borrow money? You don’t need to go through a bank – you can do it through smart contracts. Want to trade crypto? DeFi has DEXs (decentralized exchanges) where you can swap tokens without a central authority telling you what to do. Simply put, DeFi lets you be your bank, offering all the tools traditional finance offers but without the hassle.

Web3 vs. DeFi

Here’s where things get interesting: Web3 and DeFi might sound similar because they both use blockchain but focus on different things. Let’s consider in a quick table:

| Feature | Web3 | DeFi |

| Main Goal | Decentralizing the internet | Decentralizing finance |

| Technology | Blockchain, dApps, NFTs | Blockchain, Smart Contracts |

| Focus | Data ownership, online privacy | Financial independence, no banks |

| Who Benefits | Everyone using the internet | Anyone wanting control over their money |

| Cool Example | Decentralized social media, gaming | Lending, trading, earning interest |

So, Web3 is about taking the internet back from big corporations, while DeFi focuses on giving people control over their money. Both are game-changers, just in different arenas.

Permissionless Access

One of the most incredible things about both Web3 and DeFi is that they’re permissionless. Translation? You don’t need anyone’s approval to join in. No more asking banks for permission to send money or having to trust random websites with your data. For Web3, you can use decentralized apps (dApps) without sharing your personal details. Just create a wallet, and you’re ready.

In the DeFi world, permissionless means anyone, anywhere, can lend, borrow, or trade without requiring a credit score or a bank account. This is huge for people in places where traditional banking is challenging to access.

DeFi in Action

Let’s look at some real-world ways people are using DeFi. These aren’t just theories – people are already making moves:

- Decentralized Exchanges (DEXs). You can trade cryptocurrencies without requiring a company to act as a middleman. Think of it like trading baseball cards directly with someone at a park, but with crypto. Popular DEXs include Uniswap and PancakeSwap.

- P2P Lending and Borrowing. Platforms like Aave and Compound let you borrow and lend money to others without a bank in the middle. And guess what? The terms are all automated by smart contracts, so there is no human error or bias.

- Staking and Yield Farming. This is where you lock up your crypto to earn more crypto. Platforms like Yearn Finance help you maximize your gains. It’s like earning interest on your savings, but way cooler.

These examples show how DeFi is putting power into the hands of everyday people. Whether you’re a crypto newbie or a seasoned trader, there’s something for everyone.

Security and Transparency

Alright, let’s talk safety. Both Web3 and DeFi run on blockchain, which means they use cryptography (fancy word for super-secure digital coding) to keep everything transparent and secure.

In Web3, your data is safe from snooping eyes – no more wondering if some company sells your info to advertisers. You hold the keys, quite literally. In DeFi, smart contracts handle the transactions, ensuring there’s no shady business behind the scenes. You can see everything happening in real-time on the blockchain, so you know your funds are secure.

Both systems provide transparency and trust that are challenging to find in traditional finance or today’s Web2 internet. And the best part? No one can mess with the data or transactions once they’re on the blockchain.

Conclusion

So, what’s the takeaway? DeFi and Web3 are part of a more significant movement to decentralize the internet and finance, giving you control over your data and money. Web3 is about creating a more user-controlled internet, while DeFi lets you take charge of your finances without needing a bank.

Whether you’re interested in protecting your online privacy or finding new ways to handle your money, these technologies pave the way for a more open, inclusive, and user-friendly future. The next step? Dive in and explore what Web3 and DeFi have to offer!